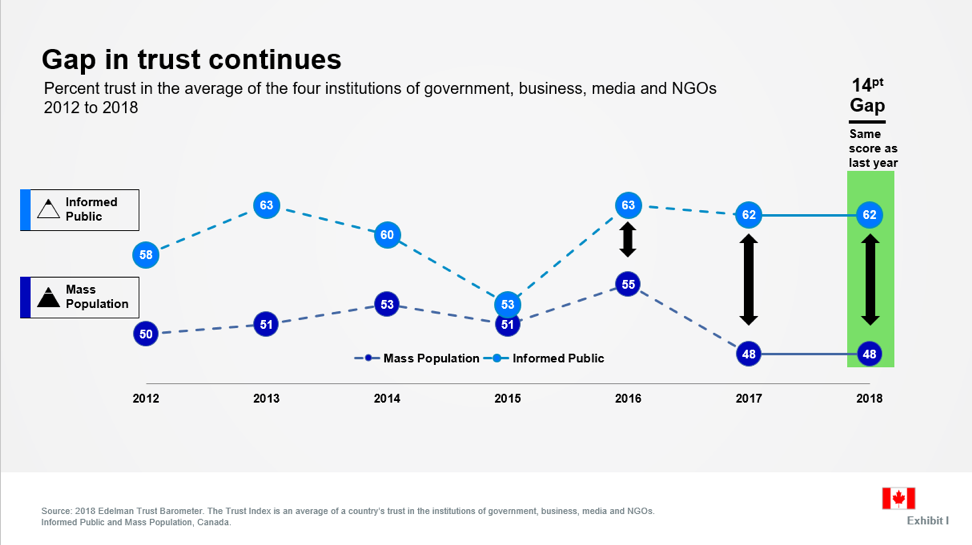

Last year the 2018 Edelman Trust Barometer revealed a world moving apart. A rising gap in trust between the mass population and informed public moved a part significantly since 2016, with trust among the informed public decreasing slightly and trust among the mass population plummeting in the last three years. In this politically charged, highly divisive climate, telling a story that can resonate across the spectrum is of the utmost importance, so it can be heard – and understood.

As we approach the release of the 2019 Edelman Trust Barometer, we wanted to shed some light on our process for gathering insights, and reveal how we assess, and prepare our clients to respond to changing levels of public trust in four key institutions in Canada: government, media, business and NGOs.

Edelman has a central office that distributes and collects the online surveys of 33,000 respondents in 27 different markets. Every sample for each country is nationally representative and stratified to the demographics of that population. Each survey is localized and translated to ensure we speak to every individual in their own language. The entire process, which has been refined over many years, operates as a well-oiled machine and data collection is finalized in about a month’s time.

In Canada, we survey 1,500 Canadians in order to maintain a margin of error of +/-3% - and we test the data using significant testing at 99% and 95% confidence intervals. This is just some fancy jargon to mean that we use statistical methods to ensure we can extrapolate our findings to the rest of the population here in Canada.

Edelman teams around the world gather to review and interpret new information and develop a narrative that explores changes in institutional trust in each of their markets. Crafting the Trust Barometer story starts at an ungodly early hour, typically with litres of coffee around the table and in a room that has been affectionately labeled the “war room.” This room is where debates happen, data is checked, and a story takes shape.

Experts from insights (yours truly), corporate communications, public affairs and executive leadership are brought together to make sense of the data we see. We take pride in making it an organized process – charting this year’s data in PowerPoint and Excel, displaying PowerPoint presentations from previous years and deliberately positioning each new slide on the wall to review one by one. By the end, what we have is nowhere near organized as we’ve strung together a host of data points, slides and eye-catching headlines. The organization comes later, after we’ve gone through each data point, and the narrative comes to life. Following our crafted narrative, we share that back with our global team to ensure absolute accuracy in the way we’re interpreting the data and share learnings from the rest of the markets.

We’re looking to the upcoming release of Trust with great interest. Several events in 2018 will have lasting impacts on Canada’s institutions: the U.S., Canada and Mexico reached a trade agreement that transformed what was NAFTA into the USMCA; recreational cannabis was legalized; the Progressive Conservative leadership took power in Ontario. These events, among others, will shape how we view trust in Canada, and how Edelman in turn helps its clients navigate the complexities of evolving, promoting and protecting their brands.

As Canada looks ahead to a federal election and the impact of ongoing global political and economic unrest, matters of trust continue to demand our attention. The 2019 Edelman Trust Barometer examines how well Canadian institutions are managing turbulence, change and confidence for the future.

On February 14, Edelman will present the global and Canadian findings of the 19th annual Edelman Trust Barometer, the world’s most robust exploration of trust in business, government, NGOs and media, surveying more than 33,000 respondents in 27 markets.

Dana Grinshpan is Director of Insights + Analytics based in Canada.